Running a small business or working as a freelancer in Ontario offers great flexibility, but tax season can feel daunting. Knowing which tax deductions are available can make a significant difference in your annual savings.

This guide will walk you through key tax deductions for self-employed individuals in Ontario, highlighting strategies to maximize your savings in 2024. For more insights on corporate tax, check out our post on the Corporate Tax Rate in Ontario 2024: Your Complete Guide.

What Are Tax Deductions, and Why Do They Matter?

For Ontario’s small business owners and freelancers, tax deductions help reduce taxable income, lowering the total tax owed. These deductions and credits are specifically designed to support self-employed professionals, enabling you to reinvest savings back into your business. To understand the impact of deductions on Ontario’s small business tax rate, refer to our in-depth guide: Ontario Small Business Tax Rate: Everything You Need to Know.

Top Tax Deductions for Ontario Self-Employed Individuals

1. Home Office Expenses

Working from home? The home office deduction allows you to claim part of your home expenses as business expenses. If you use a portion of your home exclusively for work, you may deduct costs like rent, utilities, home insurance, and maintenance fees. Calculating the deductible amount involves determining the percentage of your home used for business activities.

2. Vehicle and Travel Expenses

If you use a car for business purposes, claim deductions for expenses like fuel, maintenance, insurance, and depreciation. Remember to maintain a log of business-related travel, as personal travel expenses aren’t deductible. For freelancers who travel outside of Ontario or Canada for business, eligible travel expenses (e.g., accommodations and meals) may also be deducted.

3. Professional Fees (Legal, Accounting, Consulting)

Hiring professionals to assist with legal, accounting, or consulting needs? Fees paid to licensed professionals, including accounting and tax preparation services, are fully deductible. This deduction not only simplifies tax compliance but also helps you save on essential business services.

4. Marketing and Advertising

Marketing expenses, from online advertising to social media campaigns, are often overlooked but can add up significantly. In Ontario, you can deduct advertising expenses if they directly contribute to growing your business. This includes website hosting, branding materials, and digital marketing costs.

5. Office Supplies and Equipment

Regular purchases like paper, pens, and printer ink can be deducted as office supplies, while bigger purchases (e.g., laptops or office furniture) are classified as capital expenses. These capital costs are deductible over several years under the Capital Cost Allowance (CCA) system, providing long-term savings on larger purchases.

6. Employee Salaries and Benefits

If you employ staff, you can deduct salaries and benefits as business expenses. This includes any contributions to health benefits, Canada Pension Plan (CPP) contributions, and Employment Insurance (EI). These deductions help to offset payroll expenses, making it more affordable to grow your team.

7. Health and Safety Compliance Costs

Certain businesses require health and safety equipment to operate legally. These costs can often be deducted, as they’re essential for compliance. If you’ve invested in health and safety training or equipment, ensure these costs are recorded accurately to take advantage of this deduction.

Ontario-Specific Tax Incentives and Credits

Small Business Deduction (SBD)

This deduction lowers the corporate tax rate for Canadian-controlled private corporations (CCPCs). If your business qualifies, the SBD can reduce tax liabilities significantly, helping Ontario small business owners keep more of their profits.

Scientific Research and Experimental Development (SR&ED) Credits

If your business conducts eligible research and development, the SR&ED program offers tax incentives. Ontario-based companies can receive a tax credit on R&D expenses, reducing the financial burden of innovation.

Digital Media Tax Credit

Ontario businesses in digital media and entertainment may qualify for the Ontario Interactive Digital Media Tax Credit (OIDMTC). This credit supports the creation of digital products and offers substantial savings.

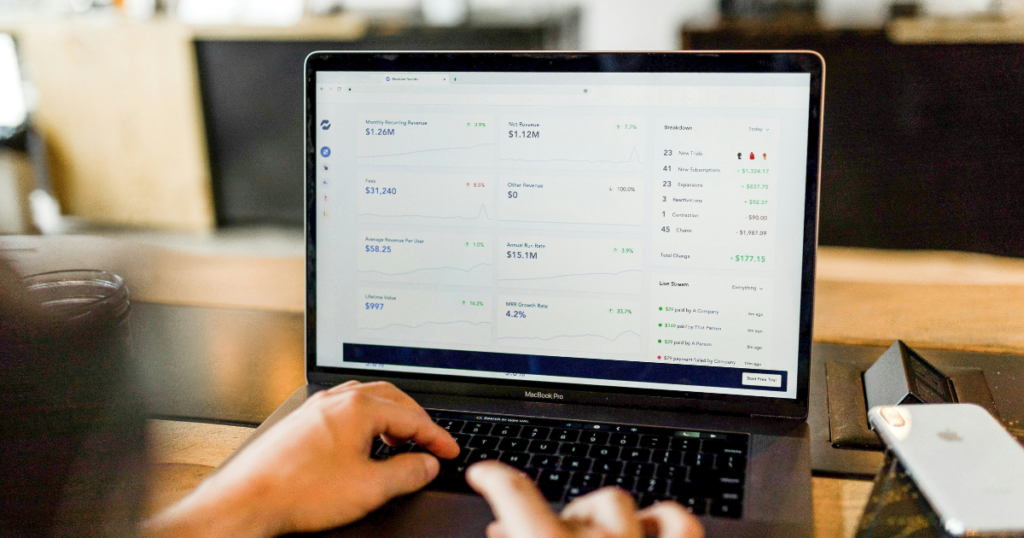

Efficient Record-Keeping for Maximum Deductions

Keeping detailed, accurate records is essential for claiming deductions. Here are some best practices:

- Use Expense Tracking Software: Tools like QuickBooks or FreshBooks streamline expense tracking.

- Store Digital Receipts: Digital copies of receipts reduce paper clutter and make record retrieval easier during tax season.

- Separate Personal and Business Expenses: Maintaining separate bank accounts and credit cards helps simplify tax filings and ensures you only claim eligible business expenses.

Common Tax Mistakes to Avoid

Failing to keep proper records or mixing personal and business expenses are common mistakes among Ontario small business owners. Also, remember to update deduction rates annually, as CRA guidelines can change. To maximize your savings, consider consulting a tax professional who understands Ontario tax regulations.

Planning Ahead for the 2025 Tax Year

It’s wise to begin tax planning for next year, as year-end strategies can increase your deductions. For example, consider purchasing needed business equipment before year-end to claim it on your 2024 taxes. By staying aware of upcoming changes in Ontario’s tax policies, you’ll be better prepared to optimize deductions in the future.

Essential Tax Deductions for Freelancers and Self-Employed in Ontario with Simplified Accounting & Tax Services Inc.

Getting the most out of your tax deductions is key for Ontario freelancers and self-employed professionals. By knowing what’s available and making smart choices, you can cut down your tax bill and keep more of what you earn.

Simplified Accounting & Tax Services Inc. is here to make taxes simpler. We help Ontario freelancers and self-employed individuals find every possible deduction and credit that fits their business. With a straightforward approach, we ensure your taxes are filed correctly, and your savings are maximized—all while staying compliant with CRA rules.

When you work with Simplified Accounting & Tax Services Inc., you’ll get practical advice and clear tax planning that takes the stress out of tax season. Let us handle the tax details so you can focus on doing what you do best. Reach out to us today to see how we can help you keep more of your hard-earned income.